.Over the years, the de minimis of imported goods to the E.U has been set at €150. Anything below that cost would be exempt from the retention of custody fees. However, commencing July 1st, 2021, the European Commission of Imports and Goods will strip the de minimis value, adding a V.A.T. (Value-Add Tax) to all imported goods i.e. EU tax.

So, you may be asking, what exactly is VAT?

So, you may be asking, what exactly is VAT? A VAT (Value Add Tax) is a type of import taxation that is placed on any goods and services coming from overseas. Most countries in the world implement some sort of a VAT on imported goods and services. Only a few countries such as the US do not have a VAT. The VAT in the E.U. is unique, however, as it is a tax that is effective in every member country and can vary between them. Export.gov states that “Member Countries of the European Union operate one common customs union with a common tariff system for third country operators. Trade between member states is free of tariffs.“ So, essentially, the VAT is only applied to imported goods.

According to the Tax Foundation, the VAT is “a consumption tax assessed on the value-added in each production stage of a good or service. Every business along the value chain receives a tax credit for the VAT already paid. The end consumer does not, making it a tax on final consumption.”

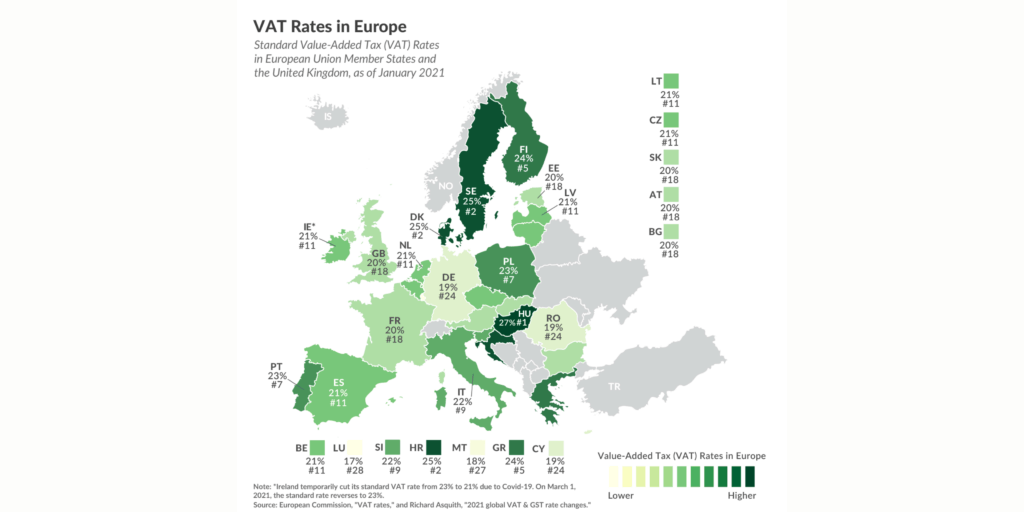

Each country in the E.U. has a different set rate for importation through its borders and sets a different levy. For example, countries with the highest VAT rate are Hungary (27%), and Croatia, Denmark, Sweden (25%). Luxembourg’s VAT is only at 18%, making it the lowest in the union. The VAT of European Union members varies widely in taxation, but all implement the VAT levy. The European Union requires that all members require a VAT rate that is at least 15%. This is due to the Union’s need to have both economic unity and unilateral communication from one country to the next.

How Are You Charged for the VAT?

The VAT is based on a percentage of the total cost of goods or services being imported and varies depending on the importation. Each member country in the EU specifies what it does and does not allow into its borders and surcharge for certain goods

According to the official website for the European Commission, the EU states

“The VAT due on any sale is a percentage of the sale price but from this, the taxable person is entitled to deduct all the tax already paid at the preceding stage. Therefore, double taxation is avoided and tax is paid only on the value-added at each stage of production and distribution. In this way, as the final price of the product is equal to the sum of the values added at each preceding stage, the final VAT paid is made up of the sum of the VAT paid at each stage.”

The VAT, therefore, is a fractioned sum that is issued at customs. This custom’s charge can be issued in different ways. If you are an individual importing goods, you will often pay the VAT for your shipment either at the delivery site or at customs itself, depending on the value of the shipment. The European Commission states that,

“You should be aware that, if you are buying goods online, you may have to pay customs duty, depending on the country that you are buying the goods from.”

However, if you are a business buying goods or services from overseas, things are more clear. A business that uses products from overseas, whether it be for company use or resell, must always pay a VAT fee at the point of import. However, you often can have this deducted later when you make your VAT declaration.

How does the New EU Tax Rate Change Things?

Now that we have a better knowledge of the VAT as a whole, let’s discuss the reason why you’re here: the new VAT rules. As was stated earlier, the de minimis for goods used to be set at a €150 cut-off. Used to be is the key element here. Now, beginning on July 1st, any imported goods outside of the EU will have the importation cost of the VAT. In the Bloomberg Tax, the new VAT rules were overviewed as, “

“On July 1, 2021, current distance selling thresholds will be abolished and all business-to-consumer (B2C) sales of goods will be taxed in the EU MS of arrival. VAT registration in all EU MSs where customers reside could be avoided if the OSS scheme is used. The OSS may therefore bring considerable savings in VAT compliance costs for businesses selling online across the EU. Any occasional input VAT could be claimed through the (EU Online) VAT refund system for non-established taxpayers.”

What Will Be Taxed?

All overseas goods will now be taxed upon arrival into the EU. The EU tax of whichever member state will be billed to the importee. With this new regulation, The EU will no longer exempt low-value goods from the EU tax. If you are a consumer, this can minimally alter both pick-up and cost of goods that are being imported from overseas. But, if a business is purchasing and importing goods from outside of the EU, the €150 cut-off does not apply.

If this sounds a little confusing, don’t worry! Let us explain. The minimum is still in place if you own a business that is considered a (B2B) business. However, the new abolishment of the de minimis value for B2C (business to consumer) is what will create the biggest change in these new rules. The de minimis will no longer be in place and every imported B2C shipment will have the VAT.

How We Here At OPAS Plan on Moving Forward with This New EU Tax

Here at OPAS, we plan on keeping our services as easy for you as possible. We are still offering shipments for B2C (business to consumer) under $200 USD (€150) with FedEx and DHL.

The VAT is in place to help regulate and promote business within the EU. However, the new EU VAT rules simply mean that the cheaper items that we ship will now have a charge. The new EU regulations only apply to B2C purchases. B2B businesses will still have the de minimis of €150 for the VAT. OPAS will try its best to keep its customers informed of international reforms and developments.